[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

LANGERIUS @langeriuseth on x 147.4K followers

Created: 2025-07-24 20:45:00 UTC

LANGERIUS @langeriuseth on x 147.4K followers

Created: 2025-07-24 20:45:00 UTC

✅ What’s true about $THQ (@TheoriqAI) tokenomics:

1- Fixed Supply: Capped at 1B tokens. Designed for long-term scarcity and sustainability.

2- Staking Mechanism: Stake $THQ → earn sTHQ → secure the network + earn rewards.

3- Locking (sTHQ → αTHQ): Lock sTHQ to mint αTHQ. Grants higher emissions + governance power.

4- Delegation System: αTHQ can be delegated to AI agents → boosts their performance + unlocks discounts + rewards for you.

5- Slashing: If agents misbehave, delegated αTHQ & sTHQ can be slashed (burned). Strong security incentive.

6- Revenue Model: Protocol fees from agent activity fund rewards, a sustainable economic loop.

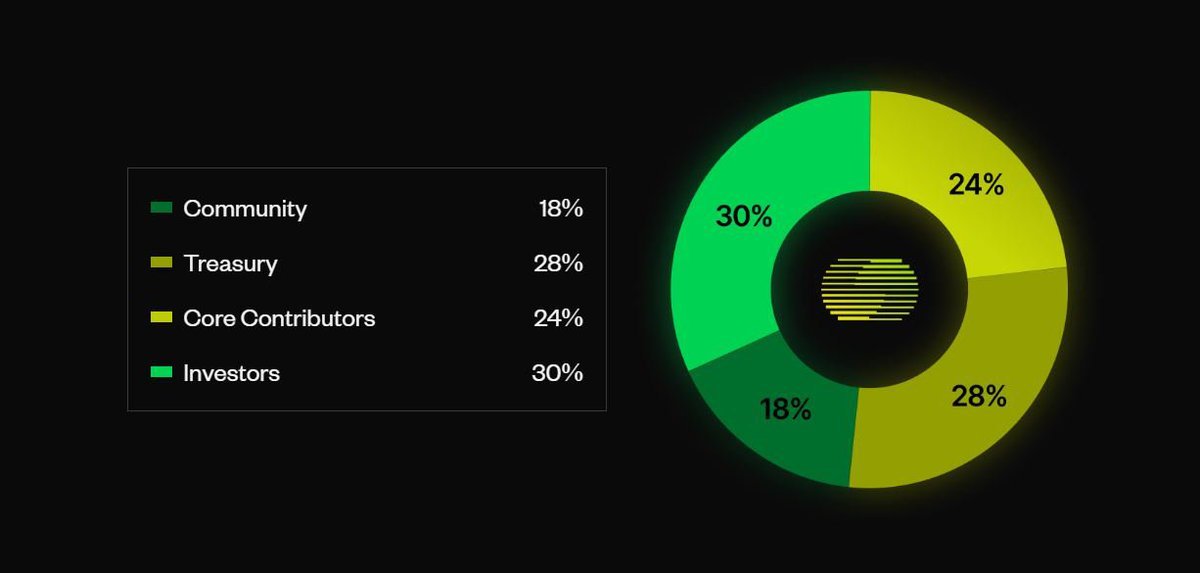

7- Token Allocation: • XX% Core Contributors (3-yr vesting, 1-yr cliff) • XX% Investors • XX% Community Incentives• XX% Treasury

8- Partner Project Access: Projects using AlphaSwarm must buy and spend $THQ for access.

9- Phased Roadmap: • Phase 1: Staking & sTHQ • Phase 2: Locking & αTHQ • Phase 3: Delegation & Agent Modules • Future: Insurance Reserves + new reward systems

❌ Common Misunderstandings:

1- “You earn passive income just by staking.”→ Not really. Most rewards come from locking (αTHQ) and delegation.

2- “Agents always bring rewards.”→ Only if they perform well. Poor performance = slashing.

3- “Token burns are constant.”→ False. Burning only happens via slashing when agents misbehave.

4- “You earn max rewards without locking.”→ Nope. αTHQ (and its emissions) only come through locking.

5- “Only early buyers win.”→ Inaccurate. Multi-year incentive programs mean latecomers still benefit based on contribution.

XXXXXX engagements

Related Topics coins ai agents coins ai governance staking longterm $thq