[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

TIM DAV @TibC4rypt on x XXX followers

Created: 2025-07-24 14:28:48 UTC

TIM DAV @TibC4rypt on x XXX followers

Created: 2025-07-24 14:28:48 UTC

gAvon

WTF is Avon?

DeFi lending has been stuck in 2020. Static curves. No competition. Protocols set your rates.

Avon flips that. With the first-ever onchain CLOB for lending, Avon brings true price discovery to DeFi credit markets.

Let’s dive in👇

X. AMMs weren’t better. They were the only option.

"We didn’t choose AMMs because they were better... They were a clever workaround for immature infrastructure." – @im0xPrince

Now, infra has evolved. And so has lending.

Welcome to @avon_xyz.

X. What is Avon?

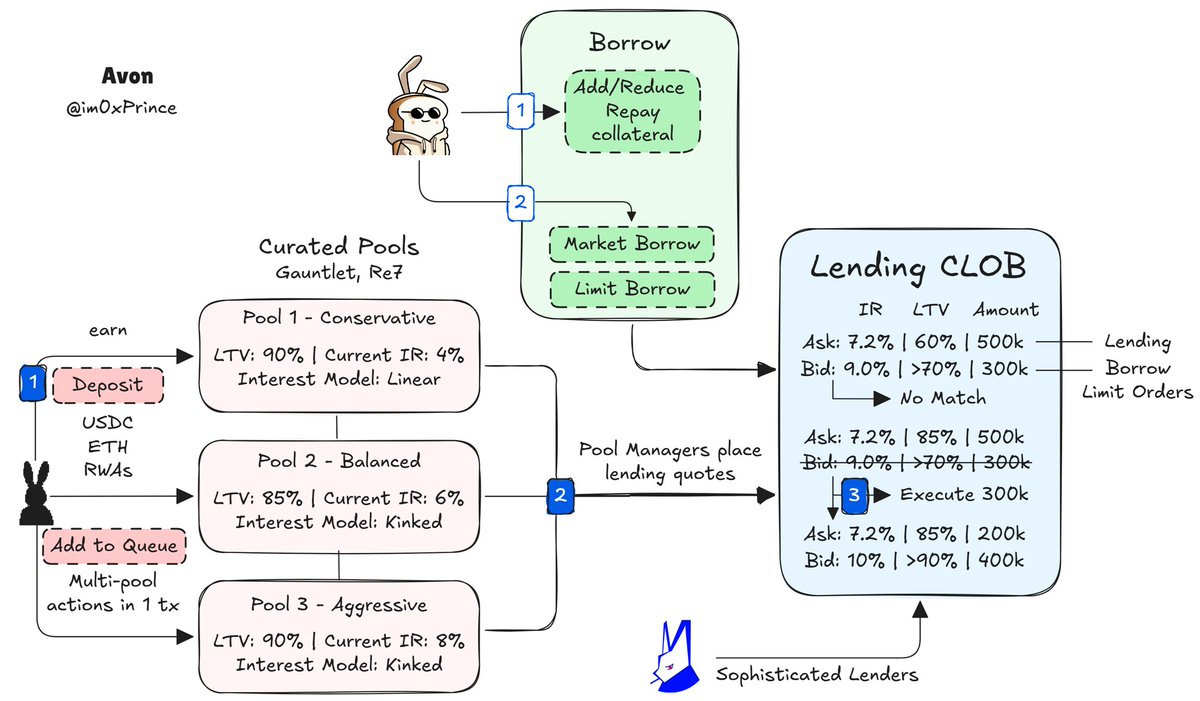

A hybrid lending protocol built on @megaeth_labs, combining:

A CLOB (central limit order book) for DeFi lending Liquidity pools for passive participation Real-time, market-driven interest rates

This is onchain credit, reimagined.

X. Why this matters

Old DeFi lending: No competition Protocol-dictated rates No customization

Avon: Open competition Custom terms (APY, LTV, duration) Market-based pricing Active and passive strategies

X. How it works

Lenders deposit into curated pools Pools post quotes onchain (APY + LTV) Borrowers take or make offers via CLOB Execution happens in real-time thanks to MegaETH

Borrowers get better rates. Lenders get flexibility and yield.

X. For Lenders

Passive – Deposit into expert-managed pools Active – Post your own quotes to the order book Competitive yields – Earn real APY from real competition Risk selection – Choose based on pool curator + profile

No more guessing rates. Compete or sit back.

X. For Borrowers

Choose market or limit orders Set your own terms (interest, LTV, term) Get matched across multiple pools Instant execution, or wait for best rates

It's the most flexible borrower UX in DeFi - period.

X. Why MegaETH matters

@avon_xyz couldn't exist on legacy L2s.

@MegaETH enables: 10ms blocks → Real-time matching Sub-second execution → Instant liquidity Unlimited gas → Complex order logic Institutional throughput

This is DeFi with an HFT engine.

X. Tech highlights

Multi-dimensional order matching (APY, LTV, term) Price-time priority for fairness Tick-based design, inspired by Uni v3 Liquidity aggregation from multiple pools Automatic requoting as utilization shifts

DeFi, but professional.

X. Key Features

Add to Queue – Bundle TXs for gas efficiency Multi-pool matching – Optimize rates Portfolio view – Track your lending/borrowing Flexible repay – Adjust collateral any time

Everything you need, on one UI.

XX. Current Status

Blue-chip tokens + major stablecoins Security audits underway Risk managed by professionals (e.g., Gauntlet, Re7) Roadmap includes RWA support based on demand

XX. Who’s building this?

@avon_xyz is led by:

@im0xPrince – First engineer @Solflare, now building DeFi’s next chapter.

This isn’t just theory. It’s execution.

XX. TL;DR

Avon brings Wall Street-grade price discovery to onchain credit. No more protocol-set rates. No more passive-only lending. No more fake competition. Just open markets.

On MegaETH. Built for this moment.

content taken from :

XX. Dive deeper into Avon

X : @avon_xyz | @im0xPrince | @AyushKek Linktree : Telegram : Try Testnet :

XXX engagements