[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Gab @GabGrowth on x 14.8K followers

Created: 2025-07-24 13:29:23 UTC

Gab @GabGrowth on x 14.8K followers

Created: 2025-07-24 13:29:23 UTC

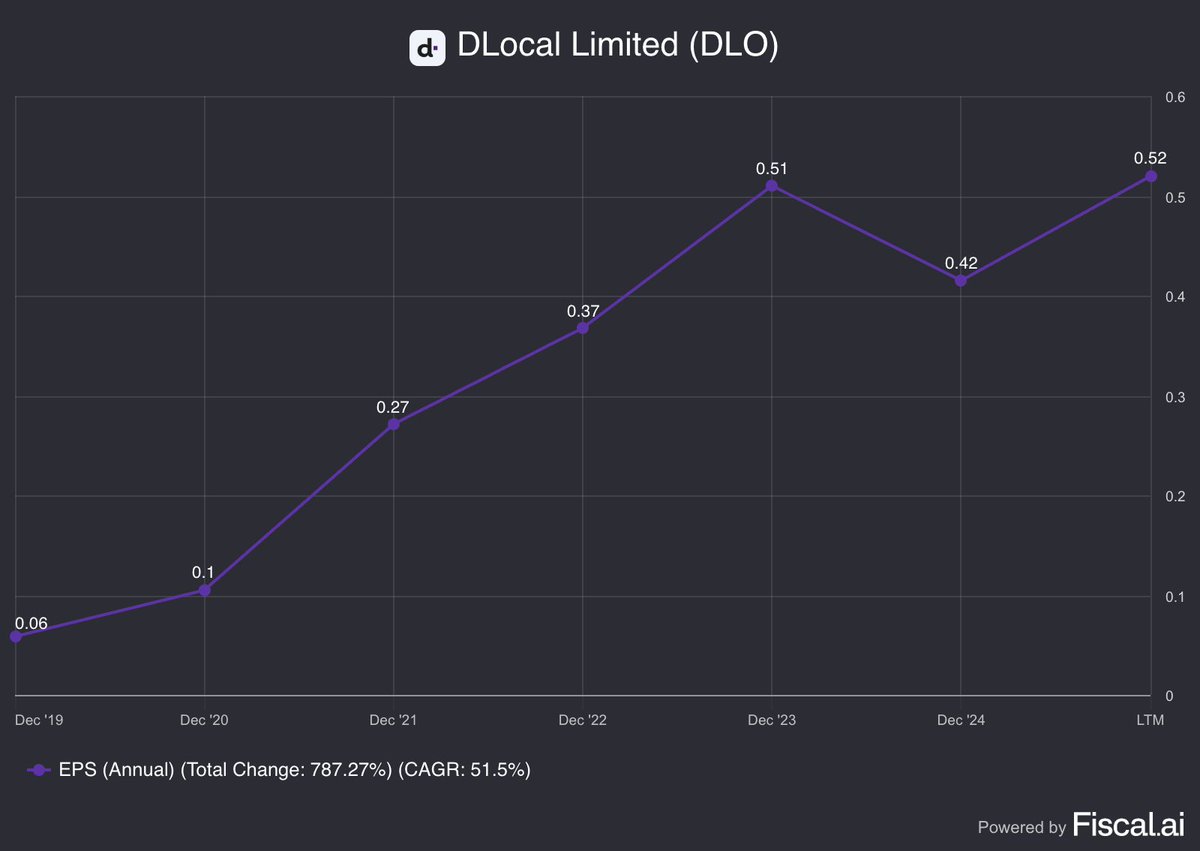

I find it hard to see shareholders losing money on $DLO

The business currently trades at $XX ($3.2B market cap).

It has grown EPS from $XXXX in 2020 to $XXXX today. It trades at just 22x PE, and the market is basically assuming the business doesn't grow EPS moving forward.

More importantly, because it acts as a toll-bridge, it has consistently high margins and consistent profits with minimal capital outlay required.

That is why the business issued a special dividend of $XXXXX in May and plans to give XX% of FCF as dividends from 2026 onwards. Management is literally saying: "We don't need all this money to grow, take it"

What happens if PE remains compressed and stock price stays low? My belief is that management will simply take the business public, possibly at $XX or so.

Management holds ~47% of shares outstanding and ~82% of voting rights, this will not be hard to go through. Why would they not take a business that is spitting out hundreds of millions in cash private if the market doesn't appreciate it?

Now, I really hope that doesn't happen, and that is the bear case scenario... but a XX% return as the bear case scenario ain't half bad.

Heads I win, Tails I win.

XXXXX engagements

Related Topics market cap eps $32b money $dlo