[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Macro84 @macro84 on x 3508 followers

Created: 2025-07-24 01:05:54 UTC

Macro84 @macro84 on x 3508 followers

Created: 2025-07-24 01:05:54 UTC

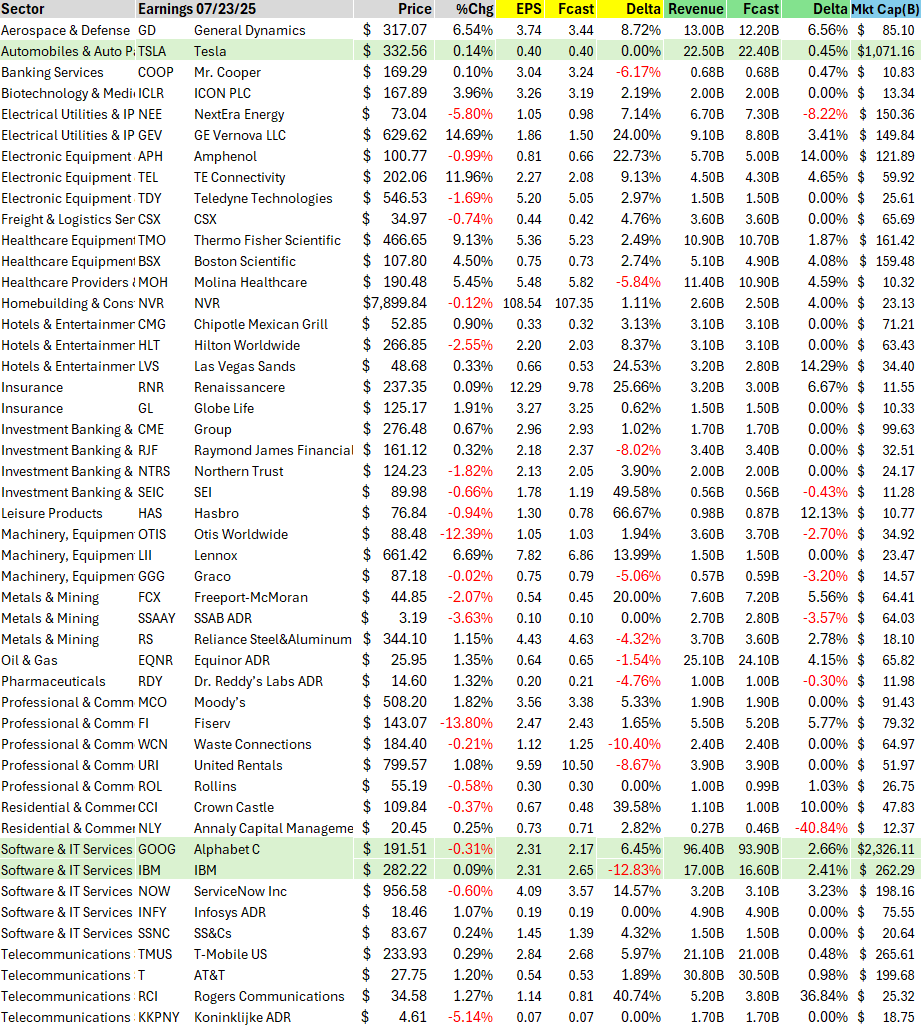

Today's earnings saw Alphabet and TESLA as well as T-Mobile and AT&T and old stalwart IBM. Only showing XX companies here with market caps over $10bn.

GOOG: Alphabet Inc. Alphabet reported robust growth driven by AI advancements across Search, Cloud, and YouTube. Double-digit Search and YouTube revenue growth, Cloud's annual run rate exceeded $50B, and strong demand for AI products fueled enterprise deals. Gemini model adoption surged, driving user and enterprise growth.

TSLA: Tesla, Inc. Tesla reported a dynamic Q2, with automotive revenue rising XX% sequentially. The company launched its robo-taxi service in Austin and plans to expand autonomous ride-hailing to cover half the U.S. population by year-end, pending regulatory approval. Full Self-Driving (FSD) adoption increased 25%. Production of new affordable models has begun, with a full ramp expected in Q4. Tesla also highlighted rapid progress in its Optimus humanoid robot program, targeting XXXXXXX units per month within five years. While short-term revenue may face pressure from reduced U.S. EV incentives and tariff risks, strong growth in AI, robotics, and energy divisions supports Tesla’s long-term outlook. CapEx is expected to exceed $9B in 2025.

TMUS: T-Mobile US, Inc. T-Mobile reported record growth in customer additions, postpaid revenue, and ARPA, driven by network leadership, business gains, and digital transformation. Raised guidance for postpaid/fiber net adds, service revenue (>6%), EBITDA ($33.3–$33.7B), and FCF ($17.6–$18B).

T: AT&T Inc. AT&T delivered strong Q2 2025 results with XXX% growth in both revenue and adjusted EBITDA. The company added XXXXXXX postpaid phone subscribers and XXXXXXX fiber customers, while generating $4.4B in free cash flow. Full-year guidance was raised for mobility service revenue and consumer wireline. AT&T plans to accelerate fiber rollout and return $4B to shareholders via buybacks in 2025, reinforcing confidence in long-term growth and capital discipline.

CMG: Chipotle Mexican Grill, Inc. Sales grew X% to $3.1B despite a X% comp decline and margin dropping to 27.4%. Adjusted EPS fell 3%. New initiatives improved trends, but full-year comps expected to be flat. Long-term targets: $4M AUVs, XXXXX locations.

IBM: International Business Machines Corporation IBM reported solid Q2 2025 results, beating expectations on revenue, profit, and cash flow, fueled by strong demand in Software and Infrastructure. The company continues to prioritize hybrid cloud and AI, highlighting resilient client demand across sectors. Despite geopolitical and federal budget uncertainties, IBM expects minimal impact and reaffirmed its outlook, citing a durable business model and steady enterprise investment.

NOW: ServiceNow ServiceNow reported strong Q2 results, beating guidance with XXXX% growth in subscription revenue and current remaining performance obligations (CRPO). Operating and free cash flow margins also improved. Momentum was driven by AI-powered workflows and record adoption of Now Assist, including a $20M enterprise deal. Management raised guidance, signaling continued strength in digital transformation and AI adoption across global enterprises.

$GD $TSLA $COOP $ICLR $NEE $GEV $APH $TEL $TDY $CSX $TMO $BSX $MOH $NVR $CMG $HLT $LVS $RNR $GL $CME $RJF $NTRS $SEIC $HAS $OTIS $LII $GGG $FCX $SSAAY $RS $EQNR $RDY $MCO $FI $WCN $URI $ROL $CCI $NLY $GOOG $IBM $NOW $INFY $SSNC $TMUS $T $RCI $KKPNY

XXX engagements

Related Topics $50b quarterly earnings youtube coins ai robust goog $10bn caps