[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mandeep Bhullar @mbhullar on x 1712 followers

Created: 2025-07-23 20:36:16 UTC

Mandeep Bhullar @mbhullar on x 1712 followers

Created: 2025-07-23 20:36:16 UTC

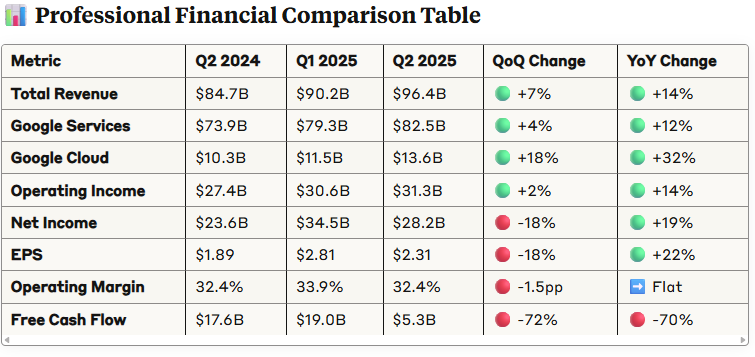

$GOOG $GOOGL Alphabet Inc.: Q2 2025 Earnings Summary

📊 Key Metrics • Revenue: $XXXX billion (+14% YoY) • Earnings per Share (EPS): $XXXX (+22% YoY) • Operating Income: $XXXX billion (+14% YoY) • Net Income: $XXXX billion (+19% YoY) • Free Cash Flow: $XXX billion (vs $XXXX billion Q2 2024) • Operating Margin: XXXX% (vs XXXX% Q2 2024) • Google Cloud Annual Run Rate: >$50 billion • Employee Count: XXXXXXX (+4.2% YoY)

🔮 Financial Outlook • Capital Expenditures 2025: Increased to approximately $XX billion • Google Cloud: Strong momentum with >$50 billion annual revenue run-rate • AI Investment: Continued significant investment in AI infrastructure and development • Growth Strategy: Focus on AI-driven products and cloud expansion

📈 Positive Highlights • Google Search & Other: $XXXX billion (+12% YoY) - strong double-digit growth • Google Cloud: $XXXX billion (+32% YoY) - exceptional growth in GCP, AI Infrastructure, and Generative AI Solutions • YouTube Ads: $XXX billion (+13% YoY) - continued strong performance • Google Subscriptions/Platforms/Devices: $XXXX billion (+20% YoY) - robust growth • AI Integration: AI Overviews and AI Mode performing well across Search • All Major Segments: Double-digit growth across Google Search, YouTube ads, subscriptions, and Cloud

📉 Challenges & Concerns • Free Cash Flow: Significant decline to $XXX billion (vs $XXXX billion Q2 2024) due to heavy CapEx • Google Network: $XXX billion (-1% YoY) - slight revenue decline • Other Bets: Operating loss of $XXX billion (vs $XXX billion loss Q2 2024) • High Capital Intensity: $XXXX billion in property/equipment purchases this quarter • Legal Settlement: Charge related to settlement of certain legal matters impacted operating margin

🔑 Strategic Updates • AI Leadership: Shipping AI products at incredible pace across all business segments • Infrastructure Investment: Massive $XX billion CapEx commitment for 2025 • Cloud Expansion: Strong growth in backlog and profitability for Google Cloud • Debt Issuance: $XXXX billion in senior unsecured notes issued in May 2025 • AI Product Launches: New AI Overviews and AI Mode features in Search

💬 CEO Quote • Sundar Pichai: "We had a standout quarter, with robust growth across the company. We are leading at the frontier of AI and shipping at an incredible pace. AI is positively impacting every part of the business, driving strong momentum."

📅 Upcoming Events • Earnings Call: Live audio webcast available on YouTube • Call Time: 1:30 PM PT / 4:30 PM ET on July 23, 2025 • Investor Resources: Available at • Q3 2025 Results: Expected in October 2025

📋 Analyst Summary Strong Operational Performance with Strategic Investment Focus: Alphabet delivered another robust quarter with XX% revenue growth driven by exceptional Google Cloud performance (+32% YoY) and steady growth across core Google Services. The company's AI strategy is clearly paying dividends with strong adoption of new AI features in Search and continued cloud momentum. Key Investment Theme: The dramatic increase in capital expenditures to $XX billion signals Alphabet's commitment to AI infrastructure leadership, though this has significantly impacted free cash flow generation in the near term.

Segment Highlights: Google Cloud's acceleration to a >$50 billion annual run-rate demonstrates the company's competitive positioning in enterprise AI and cloud services. Google Services maintains healthy double-digit growth across all major products. Risk Considerations: Investors should monitor the sustainability of current CapEx levels and their impact on cash generation, while watching for continued legal and regulatory challenges that may result in additional settlement charges.

Overall Assessment: Alphabet continues to execute well on its AI-first strategy with strong financial results, though heavy infrastructure investment is pressuring near-term cash flows in favor of long-term competitive positioning.

XXXXX engagements

Related Topics googl cash flow quarterly earnings $goog $googl stocks communication services