[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Little Coco @LittleCoco83812 on x XXX followers

Created: 2025-07-23 02:08:41 UTC

Little Coco @LittleCoco83812 on x XXX followers

Created: 2025-07-23 02:08:41 UTC

Some Mexican scholars were afraid of the relationship between Mexico and China after President Trump took the office.

China Ties Could Be a Liability for Mexico Under Trump XXX The country should make the best of a difficult situation by insisting on transparency.

Mexico’s growing ties with China have raised concerns in the U.S. and Canada. These countries fear that Mexico could serve as a “backdoor” for Chinese goods entering the U.S. under USMCA’s preferential trade terms. And with President-elect Donald Trump preparing to return to the White House and a review of the USMCA next year, more scrutiny is coming.

Mexico’s trade relationship with China has placed it at the heart of North America’s simmering economic and geopolitical tensions. What is the actual state of China’s economic relationship with Mexico?

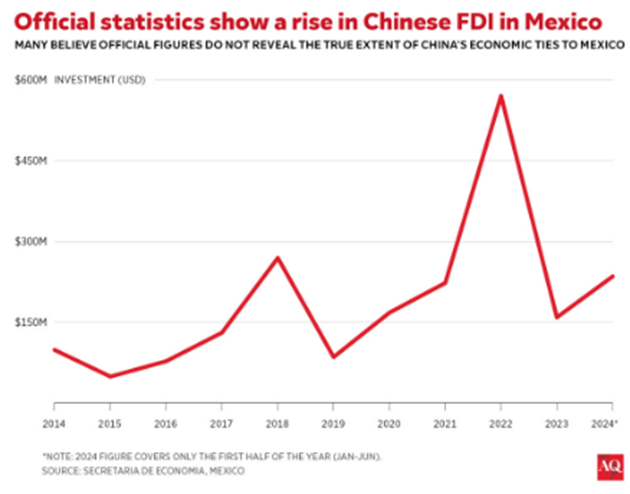

Over the past several years, Chinese companies have significantly expanded their presence in Mexico, using the country as a gateway to the North American market. Chinese foreign direct investment (FDI) in Mexico has grown at an average rate of XX% since 2018. Last year, a remarkable XX% surge in shipments from China raised eyebrows, as did China’s rapid inroads into the Mexican car market, where it now sells a fifth of all new automobiles. Chinese state-owned enterprises are involved in infrastructure-building projects across the country, and China has provided considerable amounts of surveillance equipment.

There’s also reason to believe that the true extent of China’s economic ties to Mexico are not captured in official statistics. All of this makes for vulnerability for Mexico—but Claudia Sheinbaum’s administration can make the best of it by insisting on transparency in its relationship with China going forward.

Rising economic ties between China and Mexico

A recent Kearney report highlighted a striking XX% year-on-year surge in Chinese container shipments to Mexico between 2023 and 2024. Peter Sand, chief analyst at Xeneta, an Oslo-based firm specializing in air and sea freight market analysis, characterized this dynamic as the fastest-growing trade route in the world right now. This growing trade relationship is underscored by increased Chinese foreign direct investment (FDI) in Mexico, which has seen nearly two thirds of its $XXXX billion total occurring since 2018.

The trade relationship between Mexico and China has experienced unprecedented growth. Over the last five years, Chinese exports to Mexico have increased by an annualized rate of 10.6%. In 2023, Mexico exported $X billion worth of goods to China, primarily minerals and machinery, while importing $XXXXX billion, resulting in a trade deficit of $XXXX billion.

Mexico’s industrial parks have become hubs for Chinese firms, including state-owned enterprises (SOEs). Over the past three years, the number of Chinese companies in these parks has doubled, particularly in sectors hit by U.S. tariffs, such as automotive, electronics, and consumer goods. Notably, Hofusan Industrial Park located in the bordering state of Nuevo León, hosts over XX Chinese companies.

Illustrating China’s growing influence in critical sectors of Mexico’s economy, SOEs are also involved in the nation’s infrastructure projects, such as the Xochimilco-Taxqueña light rail system manufactured by China Railway Construction Corporation (CRCC), and upgrades to metro systems in Mexico City and Monterrey. Furthermore, two of Mexico’s three major airlines lease aircraft through CDB Aviation, an Irish subsidiary wholly owned by China Development Bank Financial Leasing Co.

Hardware and software concerns

Among the industries where China could expand its presence in Mexico, few are as strategically significant—or as politically sensitive—as the automotive sector. As a global leader in car manufacturing, Mexico produces XXX million vehicles annually, with three-quarters exported to the U.S.

In 2023, Chinese firms announced $XXXX billion in automotive investments, making up XX% of all Chinese FDI in Mexico that year. This increase is mainly driven by parts manufacturers, such as ZC Rubber, which unveiled a $XXX million investment in 2024. Chinese automotive groups are investing over $X billion at Alianza Industrial Park in Coahuila, XXX km from the U.S. border. In September, the Chinese electric car maker BYD denied reports of pausing plans for a Mexican plant.

XX engagements

Related Topics countries canada donald trump china mexico coco