[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Thomas Reiner @treiner5 on x 8273 followers

Created: 2025-07-21 17:54:44 UTC

Thomas Reiner @treiner5 on x 8273 followers

Created: 2025-07-21 17:54:44 UTC

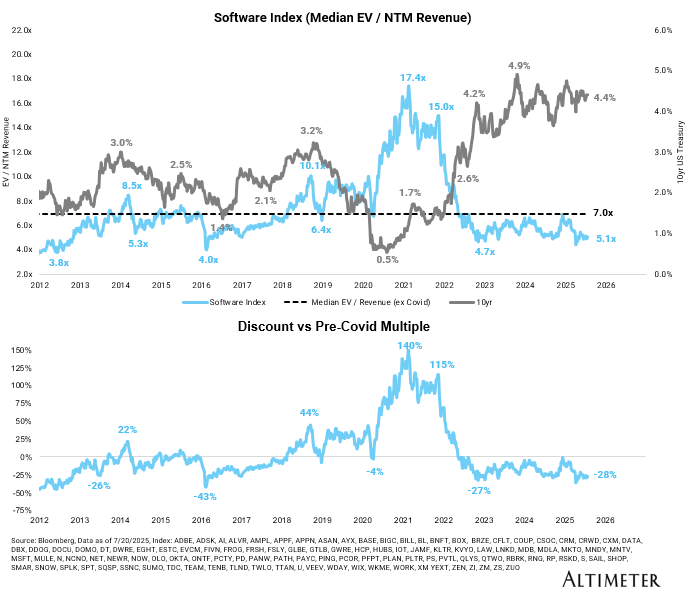

Question: Is software cheap?

Answer: Depends on the growth cohort

Overall Software appears "cheap" At a high level, software appears to be trading at 2-turn lower EV/Revenue multiple (on consensus) vs the pre-covid average.

The 10yr/RFR is significantly higher so maybe this is deserved, if you DCF the "median" software company these multiples with a 4.3-4.4% 10yr are reasonable on an industry-wide level, but it's really a tale of high vs low growth:

🟢High Growth Software (>20%) Multiples for higher growth software despite a high 10yr treasury is trading at 14x Revenue vs 8x pre-covid average. Outright expensive when you look at it on EV/Revenue. (especially when you look at names on @jaminball top XX list like $PLTR at 86x or $NET at 30x revenue.

🔴Low Growth Software (<10%) For the slower growing cohort multiples are in the dumps, trading at 2x EV/Revenue vs pre-covid average of 4x. Essentially slow growth software got whalloped by 2022 normalization and has traded at around 2x revenue ever since. The names that can be "PE'ed" have happened and what's left in the public markets is either ugly or a turnaround (like $TWLO)

💸But what about when you look at FCF?

On a FCF basis (stripping out companies losing $ and those at insanely high multiples because they're barely breakeven), software is generally trading at 32x FCF.

And let's break this down by growth cohort:

- Software growing >20% trades at 51x EV/FCF growing XX% on average (in-line with 50x avg back to 2010)

- Software growing <10% trades at 19x EV/FCF growing X% (slightly below 24x avg back to 2010)

So despite higher growth names trading at crazy high EV/Revenue multiples, they're also more profitable than in past cycles on a FCF basis. Let's look at a few examples:

$DDOG growing XX% trading at 58x FCF / 14x Rev $CRWD growing XX% trading at 85x FCF / 23x Rev $SNOW growing XX% trading at 56x FCF / 15x Rev $TOST growing XX% trading at 44x FCF / 4x Rev

A name trading at >14x revenue sounds insane but when companies are actually generating FCF it's not impossible to justify the multiples (for some of the names) vs a $CRM, $WDAY, or $TWLO on a growth adjusted basis of EV/FCF.

The market is definitely paying up for growth, perhaps more so than deserved, but it's not 2021 levels of insanity.

Multiple things can be true: 1⃣ High growth software is expensive on EV/Rev 2⃣ High growth software is fairly valued on EV/FCF 3⃣ Low growth software is very cheap on EV/Rev 4⃣ Low growth software is fairly valued on EV/FCF

❓But what about SBC? Yeah, SBC is still an issue and all these multiples of FCF can't really be comped to the rest of the investment space given the excess stock-based comp, but at least it's been improving materially since 2022. Maybe that changes if the $META AI comp plans spread to software, but the trajectory of FCF margins (incl SBC) for software have been improving.

h/t to @jrichlive for posting multiples chart and spurring me to dive deeper:

XXXXX engagements