[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Akinator Assets @AkinatorAssets on x XXX followers

Created: 2025-07-21 12:45:28 UTC

Akinator Assets @AkinatorAssets on x XXX followers

Created: 2025-07-21 12:45:28 UTC

🐂 Bull Case

1.Strong AI Acceleration Growth $AMD’s data center segment has experienced explosive growth, with a XX% year-over-year increase primarily driven by MI300 AI accelerator sales. According to search results, “AMD reported strong first quarter 2025 financial results, with revenue reaching $XXX billion, up XX% year-over-year, and adjusted earnings per share of $0.96, exceeding analysts’ expectations of $0.94, driven by significant growth in its data center segment and expanding AI momentum.” This demonstrates $AMD’s successful execution in the high-growth AI chip market.

⸻

Share Gains in Data Center $AMD is steadily gaining ground against competitors in the data center space. As noted in search results, “AMD’s position in the data center semiconductor market is well-established, and market share gains lie ahead. The slowing segment growth is due more to the law of large numbers than anything else; the $XXX billion in revenue contribution is a company record expected to be exceeded in 2025.” This indicates continued momentum in this critical high-margin segment.

⸻

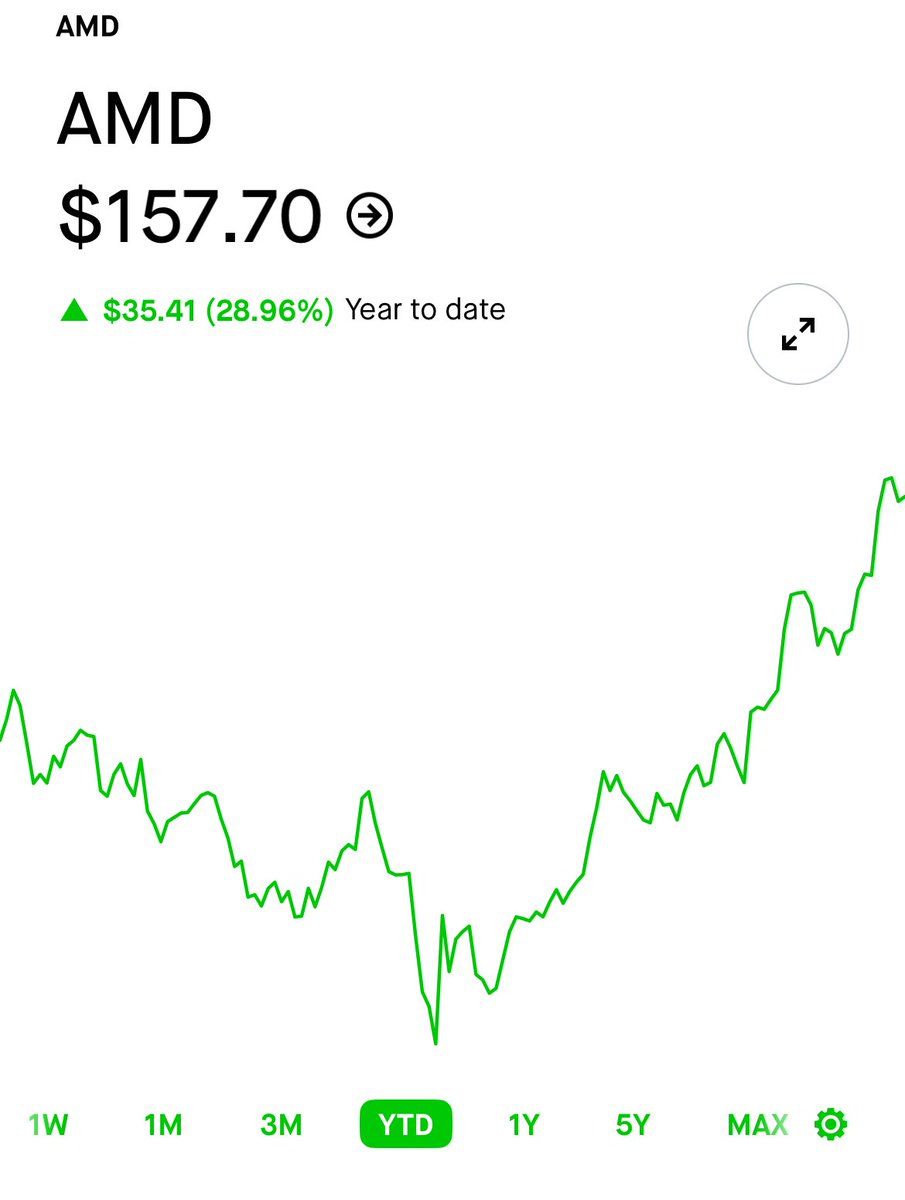

3.Strong Stock Performance Trajectory $AMD stock has shown remarkable strength in 2025, with search results indicating “Shares of Advanced Micro Devices exploded over the past month, gaining 24.45%. That strong performance has brought the chipmaker stock’s year-to-date gain to 30.80%.” This positive price action reflects growing investor confidence in $AMD’s strategic positioning and execution in high-growth semiconductor markets.

⸻

4.Diversified Product Portfolio Unlike some competitors who are heavily dependent on specific market segments, $AMD maintains a diversified portfolio across client computing, gaming, and data center markets. This diversification provides resilience against sector-specific downturns while allowing the company to capitalize on growth opportunities across multiple segments, particularly as it continues to expand its AI offerings beyond the MI300 series.

⸻

5.Competitive Alternative in AI Infrastructure $AMD is positioning itself as a viable alternative to NVIDIA in the AI chip market. According to search results, “In the hot AI chips field, eyes are on AMD vs. Nvidia as the perennial No. X again takes on a market leader.” As AI adoption continues to accelerate across industries, having a strong second player helps $AMD capture market share, especially as customers seek to diversify their AI infrastructure suppliers.

XX engagements

Related Topics quarterly earnings data center $amds coins ai advanced micro devices stocks technology