[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Azin @0xAzin on x 2951 followers

Created: 2025-07-21 09:06:16 UTC

Azin @0xAzin on x 2951 followers

Created: 2025-07-21 09:06:16 UTC

♾Amnis Finance and AMI♾

Once a quiet player in liquid staking, @AmnisFinance is now turning heads.

TVL just hit ~$180M, up XX% in the last XX days.

That’s impressive for a protocol laser-focused on efficiency — and built entirely on Aptos But that’s just the beginning 🧵👇

Behind the scenes, Amnis has been stacking revenue— Cumulative earnings now stand at $937K, just shy of the $1M milestone. For a protocol this lean, that's not just growth. That’s execution.

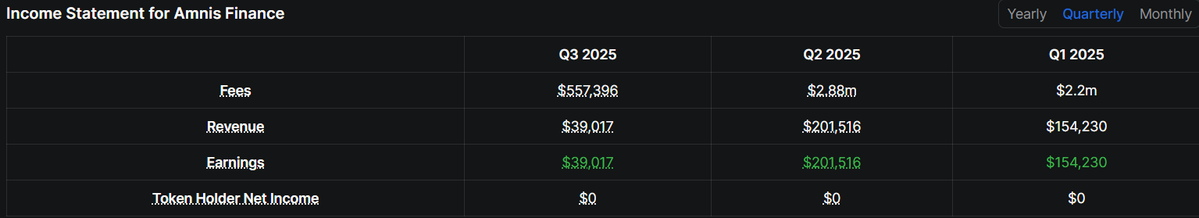

Let’s talk numbers: 📊 Protocol Fees Generated: 🔸Q1 2025: $2.2M 🔸Q2 2025: $2.88M ← ATH 🔸Q3 (so far): $557K

💰 Revenue Collected: 🔸 Q1: $154K 🔸 Q2: $201K ← ATH 🔸 Q3: $39K (and counting) Q2 was Amnis' breakout quarter — no debate.

Now zoom in on $AMI, the native token: Over the past month: 🔸 $14M in trading volume 🔸 $2.33M daily peak (June 24) 🔸 6.2K transactions 🔸 12.1K active addresses That’s not just volume. That’s organic traction.

📉 Market structure of AMI: 🔸 Fully Diluted Market Cap: $126.6M 🔸 Circulating Market Cap: $11.4M A tight float, rising usage, and real revenue. $AMI isn’t just another staking token — it’s riding the fundamentals. Amnis is proving that with the right design, DeFi on Aptos can scale — fast, efficient, and revenue-first.

XX engagements