[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cryptgeek. @Cryptgeek_ on x 27.1K followers

Created: 2025-07-20 17:29:28 UTC

Cryptgeek. @Cryptgeek_ on x 27.1K followers

Created: 2025-07-20 17:29:28 UTC

Everyone’s talking modular — but few chains walk the talk.

HyperEVM combines high-frequency orderbooks with smart contracts, bridging DeFi’s performance gap without bridges.

Here’s how it works ( & why it matters) 🧩

.....

🥷 The Old DeFi Stack: Inefficient by Design

Traditional DeFi chains force trade-offs:

• AMMs → poor capital efficiency • L2s → bridging overhead & latency • Smart contracts → no direct market access • UX → disjointed & slow

HyperEVM throws this playbook out.

.....

🧠 HyperEVM = Smart Contracts Meet Orderbooks

Most EVM chains bolt DeFi on top.

But HyperEVM integrates smart contracts directly with native, high-frequency orderbooks — built into HyperCore. No need for wrapped assets or external matching engines.

This isn’t DeFi on a chain. It’s DeFi in the chain.

.....

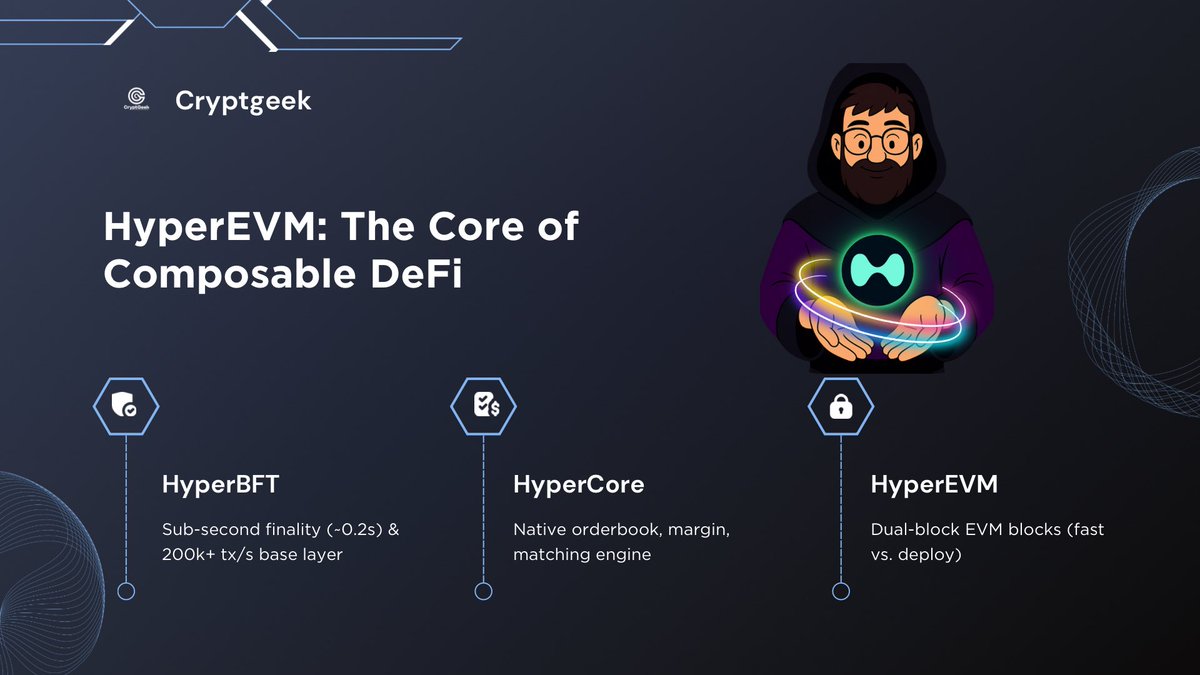

⚙️ The Hyperliquid Stack

HyperEVM is just one part of the beast. It works in sync with:

➥ HyperBFT – Lightning-fast consensus (0.2s latency, 200k+ orders/sec) ➥ HyperCore – Handles spot/perps, margin, clearing ➥ HyperEVM – Smart contract layer w/ Ethereum compatibility

One stack. No silos. No bridges. No waiting.

.....

🚫 Bridges? IOUs? Not Here.

In HyperEVM, assets move between execution layers without wrapping.

Forget wETH or stgUSDC. You get native, interoperable assets that flow from core → contract without jumping chains or losing composability.

That’s real DeFi-native liquidity.

.....

📜 HIP Token Standards = Plug & Play Assets

HyperEVM isn’t just fast. It's extensible.

With HIP-1 and HIP-2, devs can launch tokens, get them instantly recognized across DEXs, lending platforms, vaults — all within the ecosystem.

It’s ERC-20s, but with a turbo boost.

.....

🌎 HyperEVM Ecosystem.

➥ AMM & DEXs: @HyperSwapX , @KittenswapHype, @hyperbloomxyz , @HybraFinance, @gliquidx ➥ Lending & Stables: @hyperlendx, @felixprotocol , @HypurrFi, @HyperstableX, @liminalmoney, @LambdaFinance, @hyperdrivedefi ➥ LSTs: @kinetiq_xyz , @Looped_HYPE, @Hyperpiexyz_io ➥ Vaults/Derivatives: @0xHyperBeat, @KeikoFinance, @EzPairs, @hyperpnl, @TradeNeutral ➥ Trading Tools: @DefinitiveFi, @GigabrainGG , @KatoshiAI

.....

There's HYPE in HyperEVM.

Real metrics, not vaporware:

• $1.6B+ TVL (350% growth in weeks) • @felixprotocol passed $100M in loans • Dozens of projects with live contracts • 100+ tokenless builders gaining traction • @HyperliquidX now dominates DEX perp volume

Modularity = traction when done right.

.....

🧩 Why This Design Wins

Modular beats monolithic because it:

✧ Merges performance & composability ✧ Offers real onchain liquidity, not pooled illusions ✧ Removes UX pain via native integration ✧ Creates the cleanest canvas for DeFi primitives

It’s not faster Ethereum. It’s better-aligned infrastructure.

.....

TL;DR: HyperEVM Is Where Code Meets Capital

• Orderbooks + EVM in the same runtime • Bridgeless liquidity = frictionless UX • Custom token standards + dev infra • Growing TVL, lending, and protocol depth

This is DeFi’s zero-to-one design leap. Permissionless doesn’t mean primitive. HyperEVM proves that.

Know a hidden gem building on HyperEVM? Drop them in the comments.

XXXXX engagements

Related Topics stack