[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

TheUltimator5 @TheUltimator5 on x 9014 followers

Created: 2025-07-20 14:09:20 UTC

TheUltimator5 @TheUltimator5 on x 9014 followers

Created: 2025-07-20 14:09:20 UTC

The new $GME psyop this weekend:

The leap.

Since IV for GME is so low right now, there are a lot of people discussing options and how right now is a great entry point.

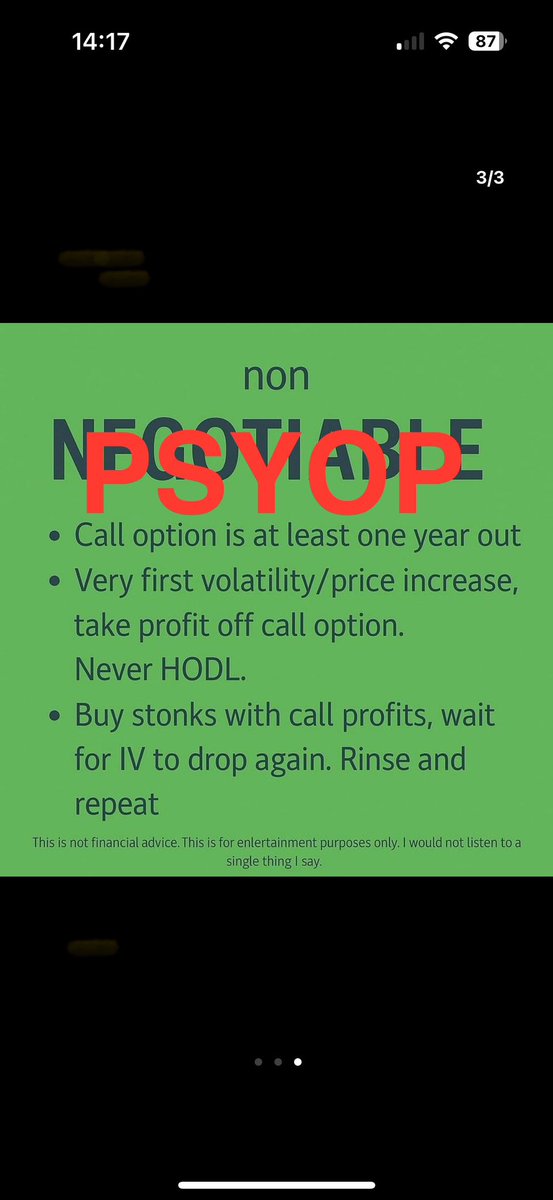

It appears that the psyop is no longer to completely shut down options as it used to be. The push is to get people to purchase ITM leaps. You may not have really noticed it since it is a subtle push, but I am seeing it pop up everywhere this weekend.

The argument? It’s safer. Theta is almost a non-factor so your value won’t decline measurably with respect to time in the short term. These accounts are also pushing to take profit and buy shares with the profit.

I will go through multiple aspects of why this is a tactic to benefit Wall Street and not retail. Obviously nothing I say is advice on how you should trade options. I am just attempting to educate so you don’t fall prey to mis/disinformation.

delta. The way the delta equations works with respect to time, is that in the money options approach a delta of X (fully hedged) as time until expiration approaches X. For the same in the money option, delta approaches XXX (50% hedged) as time until expiration approaches infinity. This means that longer dated contracts of the same price have a lower delta. This also means that as expiration approaches, the in-the money options delta starts to quickly move to X. This time-variable is dangerous to Wall Street if there are a massive amount of new in the money calls.

Cost/delta skew. Shorter dated calls are more risky and are cheaper as a result. From (1), the delta is also much higher. This means that for much less money, your options will have an exponentially greater effect on the delta hedge requirements. For example, I will math out the $XX August 2025 monthlies with June 2026 leaps of the same strike. For $XXXXXXX my $XX calls from August will yield about XXXXXX shares of delta. The same cost for the June 2026 strike will yield about XXXXX shares.

sell at first sign of profit. This is a bit more obvious, but selling the moment there is any volatility results in the options likely going back to the dealer and getting unhedged. It will dampen volatility, putting sell pressure into a run. Obviously I’m not saying to hold options forever, but make your own choices with risk/reward and understand the overarching consequences.

but shares with profits. This is another way to dampen volatility and makes the assumption that you don’t have money to exercise any options I suppose. When options are exercised, the shares are purchased in the open market by an institutional trader which has an effect on the price. When retail purchases shares, our orders (no matter the venue) get rerouted to group liquidity programs and are forced to fill at a midpoint peg, disallowing price discovery.

In summary, it seems like wall st has accepted that retail has options on their mind and is attempting to subtly push the methods of options trading that has the least impact on volatility. Is retail decides to be dumb and yolo in on closer dated ATM calls, then it could cause some real problems for them.

XXXXXX engagements

Related Topics gme iv $gme stocks consumer cyclical stocks bitcoin treasuries $psyop