[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Rohit Singh @Mr_Chartist on x 71.2K followers

Created: 2025-07-18 17:31:40 UTC

Rohit Singh @Mr_Chartist on x 71.2K followers

Created: 2025-07-18 17:31:40 UTC

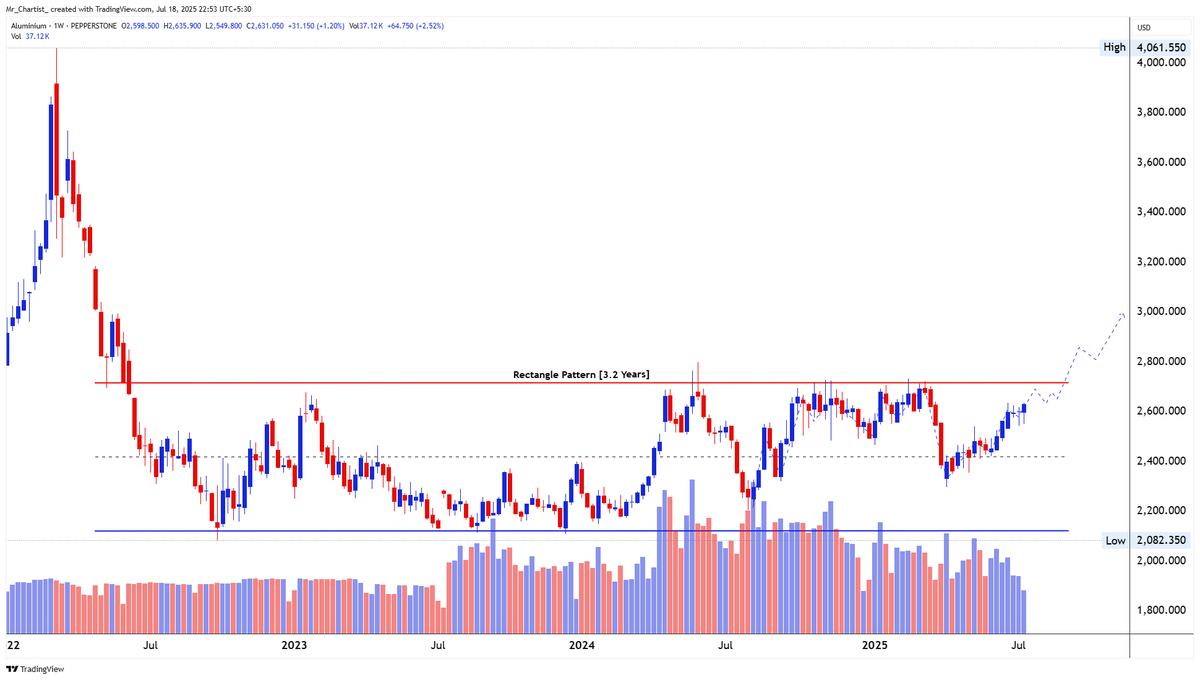

Big Breakout Soon in Commodity Chart similar to Silver Chart-

🚀 ALUMINIUM - $2631 Date: 18-07-2025 Price: $XXXXXXXX Volume: 37.12K

1⃣ Pattern Structure & Breakout Development 📈 📐 Pattern Identification: A Rectangle Pattern has been forming over XXX years, acting as a large-scale accumulation base. This is a continuation pattern typically seen in commodities post major corrections, where price builds energy for the next directional leg. ⏳ Time Taken in Formation: Over XXX weeks (~3.2 years), price has remained within a defined range. This extended time reflects long-term accumulation and the absorption of supply by institutional players. Such long bases often precede explosive breakouts. 📊 Price Trend Before the Pattern: The trend leading into the rectangle was a sharp downtrend from 2022 highs. The drop was vertical, indicating panic or macro stress, followed by multi-year stabilization inside the rectangle. 📦 Price Movement Inside the Pattern: The range has been defined by $XXXXX on the lower side and $XXXXX on the upper side. Inside this range, the price has respected support and resistance with multiple bounces, forming higher lows since early 2024, hinting at underlying strength and diminishing seller strength. 🚀 Breakout Zone & Behavior: The resistance level at $XXXXX is a multi-tested zone, tested over 5–6 times. This increases its significance. Current price is approaching this zone with momentum, and a breakout above it would activate the 3.2-year base, unleashing a possible long-term trend.

2⃣ Volume Behavior & Breakout Validity 🔍 📉 Volume During the Pattern: Volume was consistently high during the early phase of the rectangle, especially near the bottoming area, suggesting accumulation. It gradually tapered off during consolidation — classic sign of supply exhaustion. 📈 Volume Before the Breakout: Recent price candles show expanding volume near higher lows and bullish follow-through candles. This reflects smart money buildup before the expected breakout. 💥 Volume on Breakout Candle: The breakout is not yet confirmed, but once $XXXXX is taken out on weekly closing basis, we expect a clear volume spike, validating the breakout. 🔮 Volume After Breakout – What to Expect: Post-breakout, volume must remain above average to sustain momentum. Low volume on breakout would increase false breakout risk. Watch for weekly candle closes above $XXXXX with volume expansion for confirmation.

3⃣ Candlestick Dynamics & Trap Awareness 🕯️ 🔥 Candles Formed Before Breakout: Recent weekly candles include strong bullish engulfing and hammer candles, especially near the $2,400–2,450 zone. These are reliable reversal signals when formed after higher lows. 💎 Breakout Candle Characteristics (Expected): Ideally, we want a large-bodied bullish candle, closing decisively above $2,710, with minimal upper wick and expanding volume. ⚠️ Impact of the Breakout Candle: A clean breakout with follow-through would invalidate the rectangle resistance and invite fresh breakout buyers. But a failed breakout or long upper wick near $XXXXX without volume may lead to a bull trap — especially if price falls back below $XXXXX.

4⃣ Trade Setup – Entry, Exit & Risk Strategy 🛍️ 🛡️ Safe Entry: Wait for weekly close above $2,710, then enter on retest near $2,700–2,720, confirmed by a bullish reversal candle. ⚡ Aggressive Entry: Enter now near $2,630–2,650, with tight SL below the recent higher low at $2,480, anticipating the breakout.

🎯 Target Zones: Target 1: $XXXXX – round number and psychological barrier Target 2: $XXXXX – historical consolidation zone and pattern-measured move (rectangle height projected upward)

🚩 Stop-loss Placement: Conservative SL: Below $XXXXX (minor swing) Structure-based SL: Below recent higher low – $XXXXX

5⃣ SEBI Disclosure – Educational Purpose Only 📜 “This report is for educational purposes only and does not offer investment advice. Mr. Chartist (Rohit Singh) is a SEBI Registered Research Analyst under the Investology (INH000012376). Please consult a SEBI-registered advisor before taking any investment decisions. All investments carry risk. Past performance is not a guarantee of future results.”

#Trading #Investing #Stocks #TechnicalAnalysis

XXXXX engagements

Related Topics accumulation