[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-17 15:32:00 UTC

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-17 15:32:00 UTC

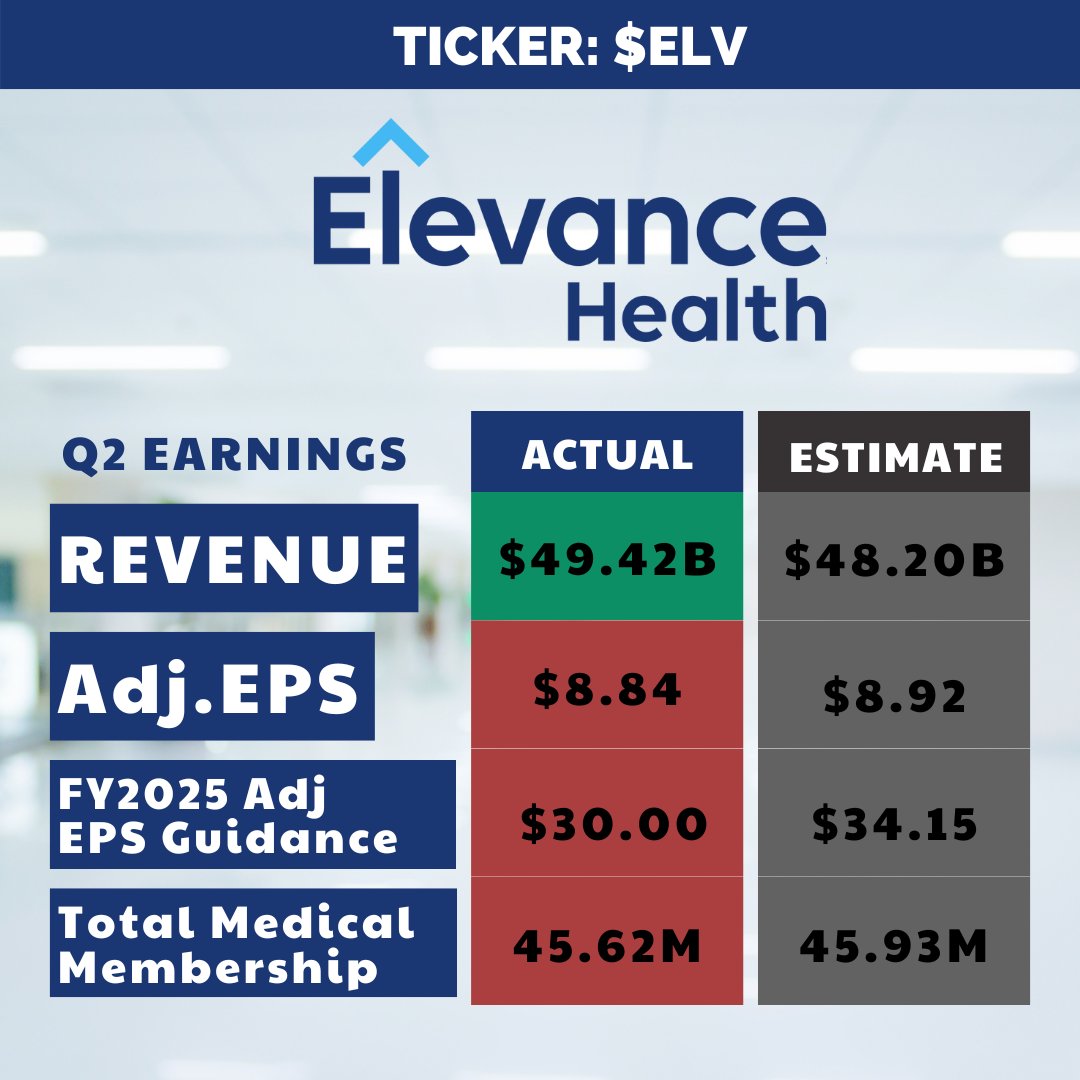

🏥 Elevance Health ($ELV) Q2 2025 Earnings Recap ⚠️📉

Elevance Health posted mixed Q2 results with strong revenue growth but rising healthcare costs that led to a guidance cut and sent shares lower.

📊 Key Metrics:

Adjusted EPS: $8.84, down ~14% YoY and missed by $XXXX ❌

Revenue: $49.42B, up XXXX% YoY and beat by $1.22B ✅

Benefit Expense Ratio: 88.9%, above the XXXX% estimate ❌

Total Medical Membership: 45.62M vs. 45.93M est ❌

FY25 Adjusted EPS Guidance: $30.00, cut from $XXXXX ❌

💬 CEO Gail Boudreaux noted that ACA and Medicaid cost pressures are driving margin strain, but the company remains focused on long-term value creation through technology, cost control, and value-based care delivery.

💵 Capital Return:

Returned $2.0B YTD to shareholders

Operating cash flow: $3.1B, up YoY 📈

📉 Stock Reaction: Shares fell ~4% in premarket trading. The guidance cut also weighed on peers like Centene ($CNC), Molina ($MOH), and Oscar Health ($OSCR). ⚠️

Despite a strong topline, margin pressure and a lowered earnings outlook raise caution flags for near-term performance. 📉

#ElevanceHealth #ELV #EarningsRecap #HealthcareStocks #ManagedCare #EPSMiss #RevenueBeat #ACA #Medicaid #StockMarket #WallStreet #EarningsSeason #BenefitRatio #EPSGuidance #HealthInsurance #InvestorUpdate #ShareholderReturns

XX engagements

Related Topics fund manager $122b $4942b eps metrics stocks coins healthcare quarterly earnings