[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ben Kizemchuk @BenKizemchuk on x 6281 followers

Created: 2025-07-17 14:14:19 UTC

Ben Kizemchuk @BenKizemchuk on x 6281 followers

Created: 2025-07-17 14:14:19 UTC

Tariffs function as a tax, withdrawing money from the private sector and reducing net financial assets.

With the change in government spending held constant, this represents a net fiscal drag on the economy.

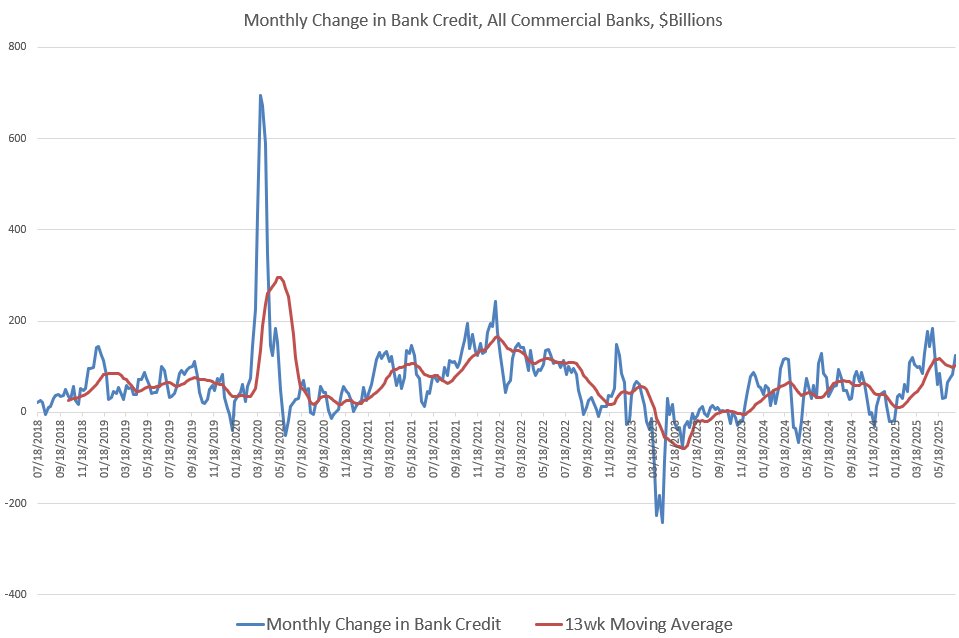

However, recent data shows that the private sector is compensating for this tariff withdrawal through a significant expansion in bank credit.

The 13-week moving average of the monthly change in bank credit has surged to $XXX billion, compared to a 2023–2024 average of just $XX billion. This increase reflects a sharp rise in private money creation via commercial bank lending since Jan 2025. For comparison, tariffs collected $XX billion in June -- a net difference of ~+$74Billion per month to the private sector, which is likely to continue growing in my opinion.

Because bank lending creates new deposits, this expansion in credit represents a net injection of money into the economy. The scale of this private credit growth has more than offset the monetary drain caused by tariffs, allowing nominal economic activity to continue expanding.

My conclusion is that despite the fiscal tightening effect of tariffs, the economy has avoided an immediate recession due to the counterbalancing force of private credit creation. This is the initiation of the dual-engine economy I have been writing about.

XXXXX engagements

Related Topics government spending money tax bracket tariffs