[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

matthew sigel, recovering CFA @matthew_sigel on x 45.2K followers

Created: 2025-07-17 12:49:13 UTC

matthew sigel, recovering CFA @matthew_sigel on x 45.2K followers

Created: 2025-07-17 12:49:13 UTC

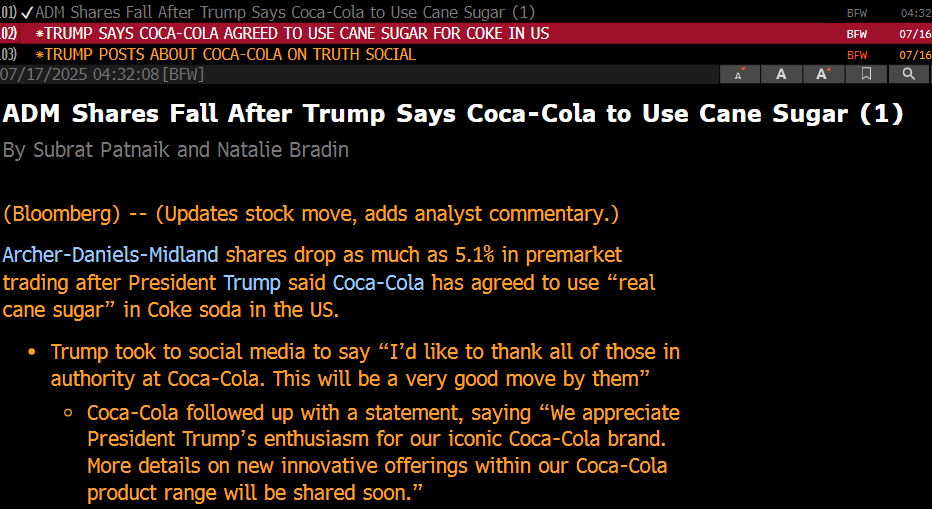

$ADM -X% pre-market after Trump said Cola-Cola has agreed to use "real cane sugar".

Even a partial shift = 1–2M tons of new sugar cane demand, a 1.5–3% shock to a finely balanced global market. Raw sugar is highly price-elastic at the margin, so could lift prices 10–25%.

AGRO crushes 13M tons/year, ~1.5% of global cane. A 5¢ rebound = +$60M EBITDA, or +18% vs $329M sellside estimate.

Less ethanol = less BTC mining, but mining only when power is cheap = higher ROI.

$AGRO

XXXXX engagements

Related Topics adm brazil mining bitcoin mining $agro $329m $60m tons