[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Equity Insights Elite @EquityInsightss on x 46.9K followers

Created: 2025-07-17 06:52:39 UTC

Equity Insights Elite @EquityInsightss on x 46.9K followers

Created: 2025-07-17 06:52:39 UTC

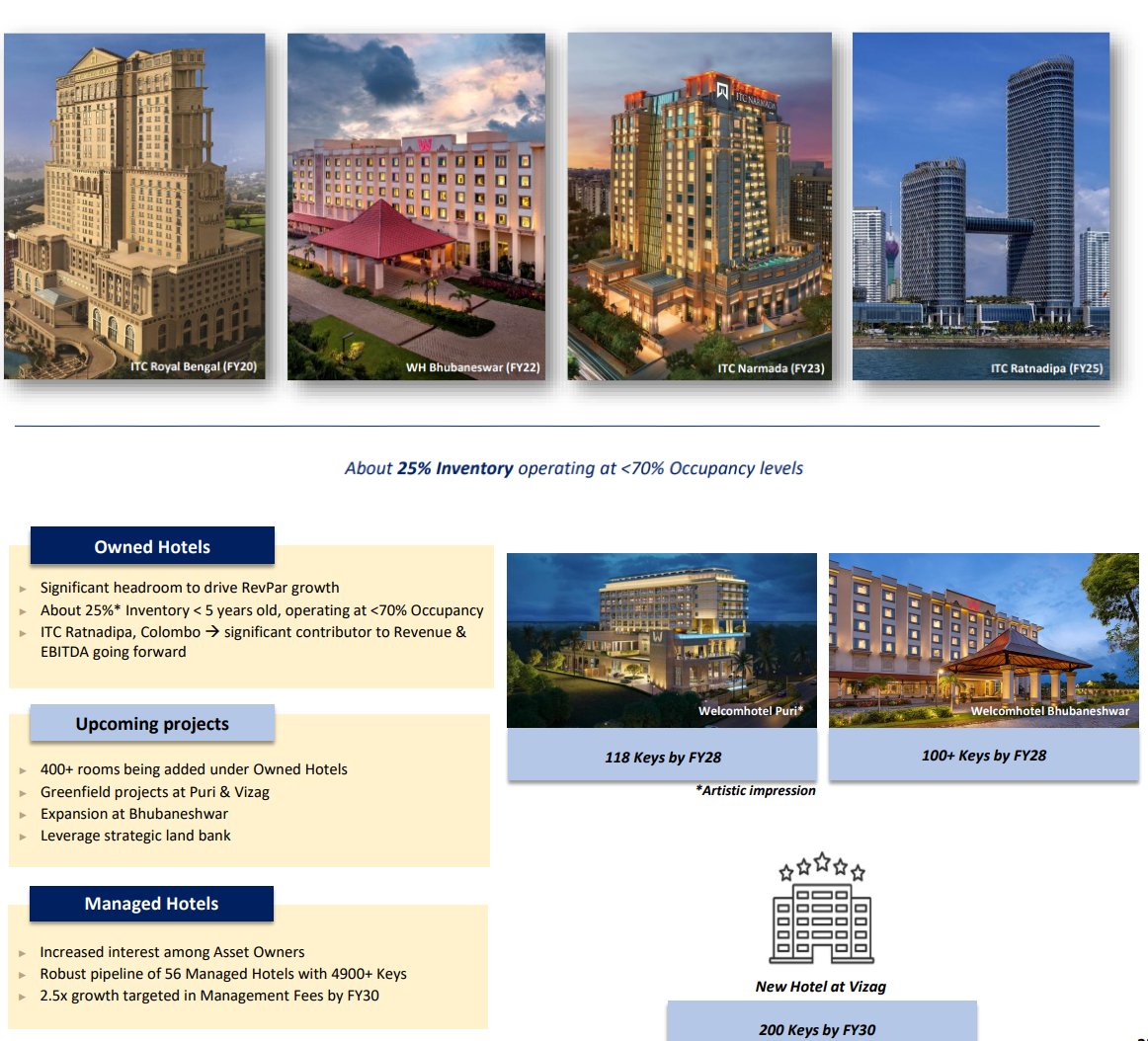

ITC Hotels : Valuations & Future Outlook

Q1FY26 REV🔼16% – XXX Cr EBITDA🔼19% – XXX Cr EBITDA margin🔼85 bps – XX% PAT🔼53% – XXX Cr

Occupancy🔼275 bps - XX% RevPAR🔼13% - 7900 ADR🔼9%

XX% RevPAR Premium over Industry

Total Portfolio: XXX hotels operational with 13,300+ keys

Mix by Keys Owned : XX% , Managed : XX%

Target: XXX operational hotels & 20,000+ keys by FY30

Mix Target by Keys Owned : XX% , Managed : XX%

Focussing on Asset‑Right growth model 2.5x growth targeted in Management Fees by FY30

XX hotels in pipeline with 5300+ keys

Q1 signings: X hotels (~700 keys) across X cities

XX hotels signed & XX Hotels opened in last XX months On track to open average > X hotel per month in the next XX months

XX% Inventory < X years old, operating at < XX% Occupancy

Valuations on higher side

- FY25 EBITDA at 1211 Cr Can do 1400+ Cr EBITDA in FY26 At 33-34x EV/EBITDA on fwd basis

XXXXXX engagements

Related Topics $itcbo