[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DivyQueen 🇺🇸 @DivysQueen on x 1299 followers

Created: 2025-07-15 00:22:54 UTC

DivyQueen 🇺🇸 @DivysQueen on x 1299 followers

Created: 2025-07-15 00:22:54 UTC

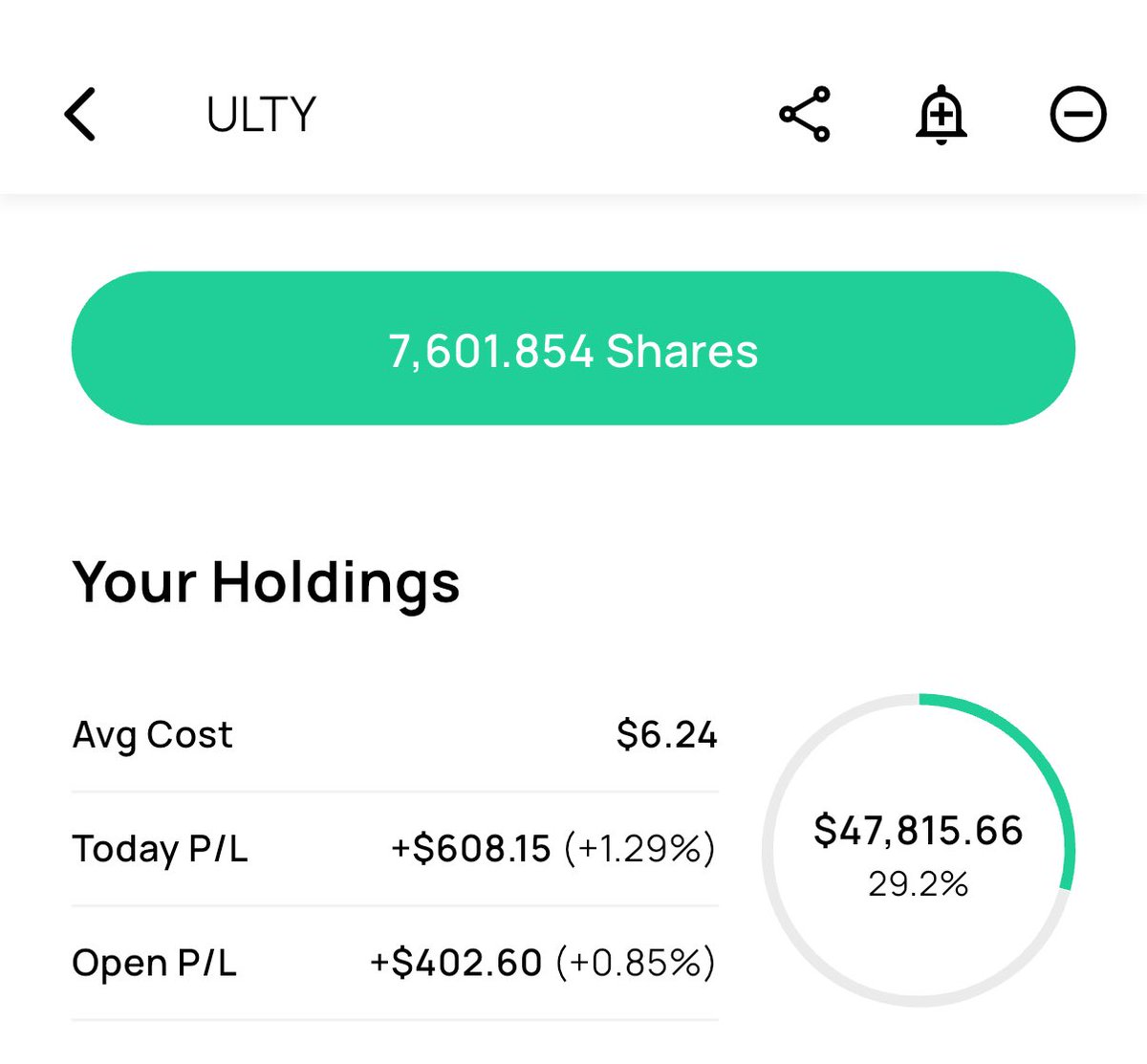

I’ve got over $40K in $ULTY and can’t get enough of its weekly dividends—it’s a standout for my passive income portfolio.

Here’s what made me consider $ULTY:

Unmatched XXXXXX% yield: Weekly payouts of ~$0.08–$0.15/share deliver exceptional cash flow, perfect for daily buys and drip those dividends.

Active management: The ZEGA Financial’s options strategy targets high-volatility stocks, with recent prospectus updates (dynamic rotation, put hedging) boosting NAV stability (+33.54% over X months).

Outshines peers: SCHD (3.4%), VYM (2.9%), JEPI (7–9%), and QYLD (11–12%) lag far behind in yield.

Drawbacks or Downside: XXXX% expense ratio is steep, and volatility can pressure NAV, though recent changes mitigate this.

Why it compelled me: High income, tax-efficient ROC distributions, and a steady $X range share price make it liquid and accessible.

You can review the prospectus at if you want to find out more.

XXXXX engagements