[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DΞFI PΞNIΞL (🧠,🧠) @Defipeniel on x 85.5K followers

Created: 2025-07-14 11:40:24 UTC

DΞFI PΞNIΞL (🧠,🧠) @Defipeniel on x 85.5K followers

Created: 2025-07-14 11:40:24 UTC

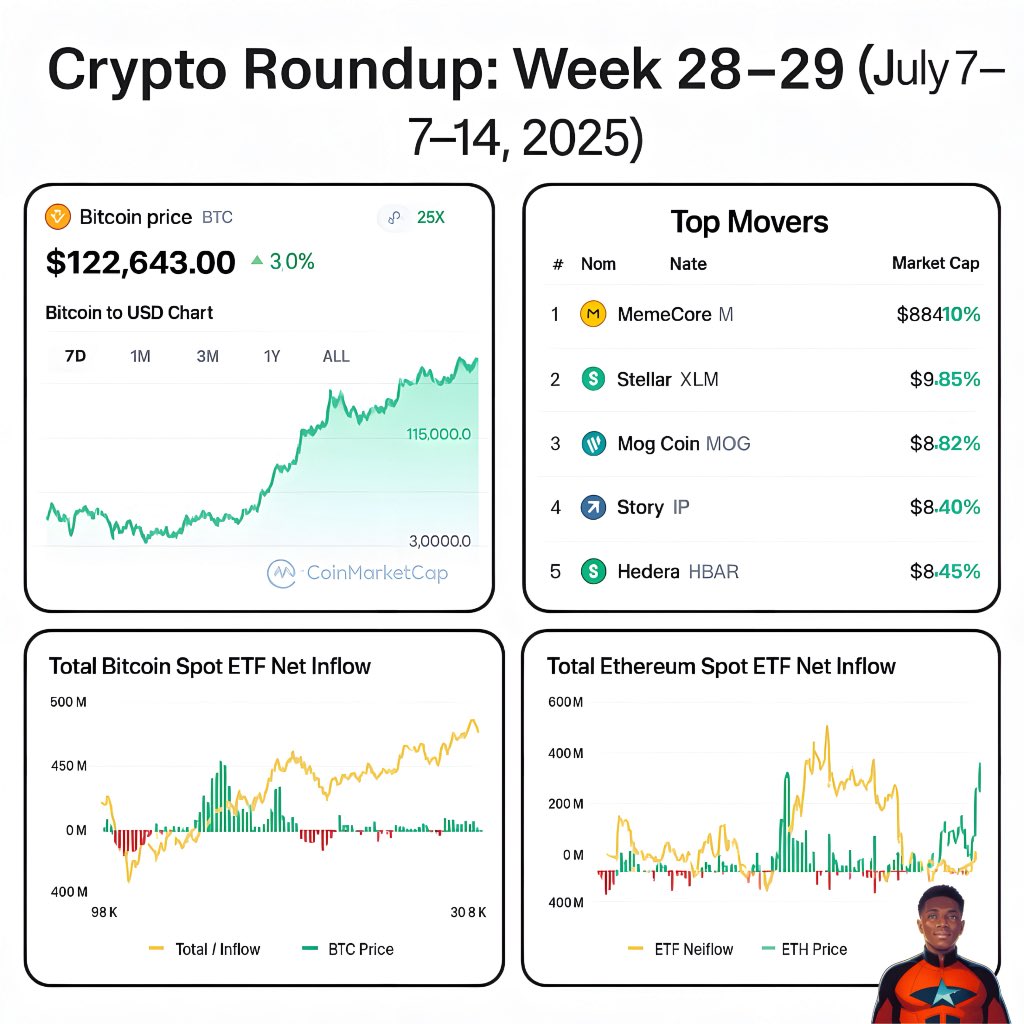

🧠 Crypto Is Rewiring Itself (Week 28–29 Recap | July 7–14, 2025) The clearest institutional signal we’ve seen since ETFs launched.

◆ Market Narrative

This week wasn’t just bullish it was a blueprint for the next cycle.

✅ Bitcoin broke another ATH ✅ Ethereum outpaced it ✅ Institutions got louder, smarter, and deeper

But beneath all the noise…

The stack is quietly shifting. Ethereum is becoming the reserve asset of crypto-native capital.

◆ Major Market Moves

BTC → $XXXXXXX ATH → $2.4T+ market cap → $2.72B ETF inflow (7D) → $1.18B daily inflow (July XX alone) → ETF AUM now $158B+

ETH → $XXXXX (5-month high) → $380B market cap → $907M ETF inflows (7D) → $210M daily inflow (July 9) → XXXX% of supply staked

ETH is no longer just “tech infra” it’s now financial collateral.

◆ Institutional Moves • BlackRock’s BTC ETF: Back-to-back $1B+ inflows • SharpLink: Bought 10K ETH OTC to hold + restake • BitMNR & BitDigital: Pivoted treasury strategy entirely to ETH • ETH ETFs: Second-highest inflow on record this week • ETH holders via 13F filings: $5.1B institutional accumulation

The signal? Institutions are not diversifying, they’re positioning.

◆ Top Movers (>$200M MC) • $M: +840% • $XLM: +85% • $MOG: +82% • $IP: +49% • $HBAR: +45%

Sector Gains • DAGs: +38% • Modular Chains: +27% • RWA Infra: +26% • DEX Aggregators: +25% • Perpetuals: +22%

◆ VC + Infra Capital Flows • @pumpdotfun raised $500M in XX minutes • Agora (Stablecoin infra): $50M (Paradigm) • Harmonic AI: $100M Series B (Kleiner + Paradigm) • ZeroHash: Raising $100M @ ~$1B valuation • ReserveOne: Targeting $1B raise pre-Nasdaq

Memes, Infra, and AI are no longer side bets. They are core allocations.

◆ Global Headlines • ETH ETFs: 11th consecutive week of inflows • Kraken & Backed: Launch tokenized equities on BNB Chain • Dubai: Approves tokenized MM fund w/ Qatar National Bank • Australia: Advances Project Acacia (CBDC + tokenized settlements) • acquires Kolscan (Solana wallet tool) • Myriad Protocol launches on Linea powered by EigenCloud • GMX exploiter returns $40M voluntarily

◆ Regulatory Front #CryptoWeek Begins

Congress is reviewing major crypto bills: • GENIUS Act (crypto clarity) • CLARITY Act (stablecoins) • Anti-CBDC Bill

This week could define how U.S. crypto scales into global finance.

Meanwhile, XRP surges ~40% ahead of a possible SEC appeal withdrawal (vote July 17).

◆ What to Watch (Week 30) • Final votes on CryptoWeek bills • New ETF filings (Cardano, XRP, Modular L1s) • ETH restaking momentum (post-Pectra + EigenLayer effect) • Rotations into BTCFi, AI‑DeFi hybrids, RWA • Token unlocks and treasury reshuffling

✍️ Final Thought

This wasn’t just a price rally. This was a structural inflection point.

Bitcoin led. Ethereum sprinted. Institutions laid bricks. The stack is evolving.

If you still frame ETH as “just a smart contract chain,” you’ve already missed the alpha.

→ Stay sharp. Stay early. Stay positioned. @defipeniel

XXXXXX engagements

Related Topics stack dfi bitcoin coins layer 1 coins bitcoin ecosystem coins pow ethereum