[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Crypto Katze @CryptoKatze on x 1872 followers

Created: 2025-07-11 13:54:40 UTC

Crypto Katze @CryptoKatze on x 1872 followers

Created: 2025-07-11 13:54:40 UTC

Virgenity Analysis Through SWARMCopilot 🧢

This week I am testing $SWARM copilot made by @TheSWARM_ai

For today's data analysis I took a 48H snapshot (9th 10.45am to 11th 10.45am CEST) of $VIRGEN transaction data.

I was interested to see what sort of wallets are trading VIRGEN since the BTC ATH.

If you remember from yesterday, I analysed VADER and showed you how SWARMcopliot helps you analyse the DNA of Wallets entering trades in real time.

Note: All data extraction, cleaning, and visualisation was done manually by me. This is not a feature.

Explanation post: Vader Analysis:

Data Collection and Methodology

I extracted XXX Data Points from GeckoTerminal with the Chrome extension live for VIRGEN

I wanted to know the

- Reputation of the wallets

- Flow of money

- The Epoch of the trades

- Their IQ

- And the mass of the trading wallets

Data was extracted, cleaned, analysed, and visualised in excel.

X lines were removed during analysis due to many blanks, leaving the total data used to XXX.

And analysis of the value "Contract" was ignored for Intelligence and Epoch (219)

Results 1: IQ - Some intelligent traders showed up, but most were average.

Intelligence of the wallets was the first indicator I looked at.

IQ measures realised trading performance and how well the wallet generally performs in trades.

The key statistics here was that most of the wallets were of average intelligence.

With over XXXX% being of average intelligence, XXX% high average, and XXX% below average.

Which just means that most of the VIRGEN traders (81.6%) were within the expected range and have typical/average performance for token peers.

Next we had a few in other categories.

We had also had some smart ones: Einstein (0.4%), Genius (2.4%), and Gifted (0.4%)/

Nice to see some smart traders showing up to VIRGEN.

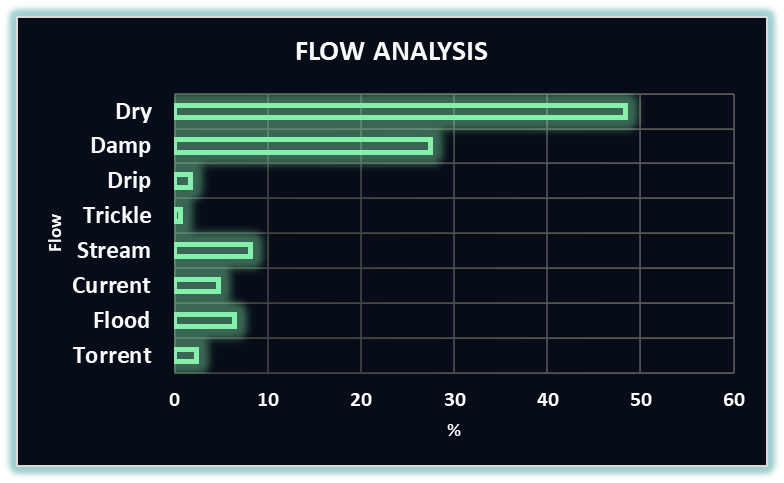

Results 2: Flow - Flow was mostly dry, but some notable high flow.

Flow quantifies buy/sell volume initiated by the wallet.

Similar to the results yesterday with VADER, there is a high concentration of flow in the Dry, Damp, and Drip areas (77.5%).

Which again indicates that the wallets mostly have low or insignificant trading volume with minor influence on the token.

This is likely due to a high concentration of trading activity in the High Cap market, rather than down here in the trenches with the Virgens.

Notable results showed that there was a bit of activity with higher flow (Torrent (2.4%), Flood (6.5%), and Current (4.8%)), all impacting the price direction (today it was influenced in a green direction!)

Results 3: Epoch - OGs are showing up!

Epoch measures how early or late a wallet entered a token relative to its lifecycle.

The results showed a higher concentration of Ultra OG, OG, Genesis, and Early Adopter showing up (79%).

Indicating a high proportion of those with HIGH conviction and early backers interested in trading VIRGEN

Virgenity.

Results 4: Mass - Some big wallets showing up! However, some Ghosts are there.

Mass measures how much of a token’s total supply a wallet holds.

From the analysis, it was clear to see that some big wallets/holders were showing up.

Dolphins lead the chart with XX% and a couple Orca joining in too with 0.86%, showing prominent, purposeful participants are trading VIRGEN.

The were some small fries showing up too: Fish (9.9%), Minnow (1.5%), Shrimp (3%), and Plankton (17.5%)

So, those with small portions of the supply continue to also show interest

XXXX% were ghosts which are those who hold none, likely exiting and losing their Virgenity.

Results 5: Reputation - Some stable and reliable wallets showing up.

Reputation measures holding behaviour after a wallet enters a token (Scored A–F).

It rewards conviction (buying more, holding long) and penalises early exits.

From the graph it's clear there's a high concentration of wallets with reputation between A- and C+.

Indicating that the general wallets entering the trades have some reliability, stability, and are holding on to their Virgenity in most cases.

Conclusion

From my analysis, it's clear that some bigger players are showing up, especially OGs. Some conviction and Virgenity remains in those trading the VIRGEN chart.

It's not ALT season yet, but it is interesting to have a look to see if there is any rotation happening while the attention sits on BTC and ETH (and other big caps).

Whales are not entering into VIRGEN right now and I feel they are waiting for confirmation in the ALT charts, they are already holding their moon bag, or their needs to be more attention driven to VIRGEN itself.

However, some big players are showing up nonetheless.

I've heard whispers that their might be things in the pipeline to help look after VIRGEN.

The final question though... are you still holding on to your Virgenity?

Let me know your thoughts on this analysis !

Cap Stays On.

XXXXX engagements

Related Topics vader coins wallets cest $swarm $virgen bitcoin coins layer 1 coins bitcoin ecosystem